MilHojas

Registered

- Joined

- Oct 9, 2007

- Messages

- 1,331

- Likes

- 959

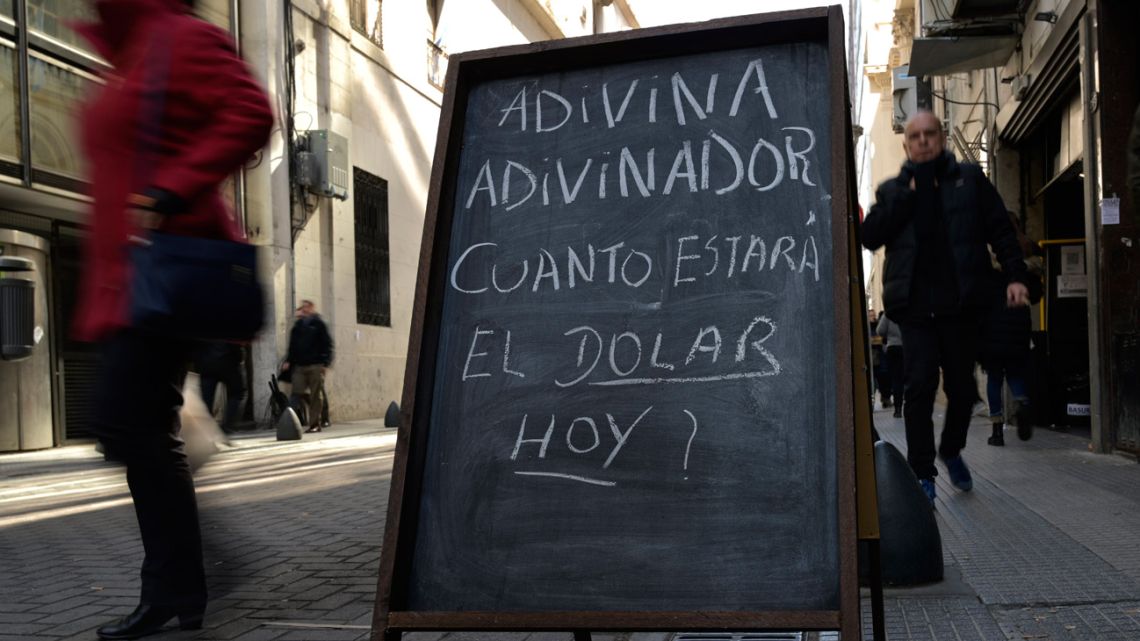

Central Bank seen seeking weak peso under Fernández

Fernández has promised voters he will revive the economy from its slump. He now intends to make the Central Bank a centrepiece for that strategy.

President-elect Alberto Fernández is preparing to task the country’s Central Bank with trying to boost the crisis-torn economy through a weak exchange rate, according to two people with direct knowledge of the strategy.