MilHojas

Registered

- Joined

- Oct 9, 2007

- Messages

- 1,803

- Likes

- 1,646

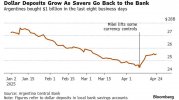

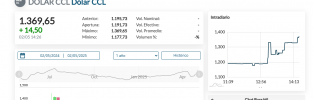

Argentine savers are going back to the bank to buy dollars after President Javier Milei granted them complete freedom to do so after five years of strict currency controls, at a time when many view the greenback as cheap.

Archived version