I know this topic has been discussed before (and I know I haven't frequented these forums in a while) but I'm intrigued. Any thoughts on the issue, from Americans or not would be appreciated.

This appeared in red in the Drudge Report, the headline being Amnesty for Immigrants.

It would appear to me that the US is following the same steps as the Roman Empire: Seeking Universalism. The gentry leaves or regulates or ascend in Nepotism, and 'Barbarians' are given citizenship.

Hispanic is the New Germanic.

Welcome to the Holy(woody) American Empire of Hispanic Nations.

http://www.businessw...gher-rules-loom

Americans renouncing U.S. citizenship surged sixfold in the second quarter from a year earlier as the government prepares to introduce tougher asset-disclosure rules.

Expatriates giving up their nationality at U.S. embassies climbed to 1,131 in the three months through June from 189 in the year-earlier period, according to Federal Register figures published today. That brought the first-half total to 1,810 compared with 235 for the whole of 2008.

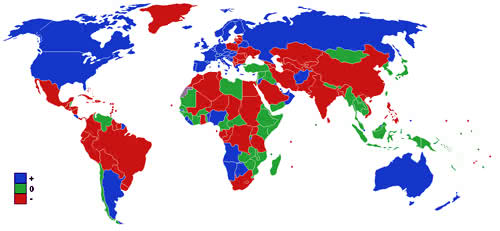

The U.S., the only nation in the Organization for Economic Cooperation and Development that taxes citizens wherever they reside, is searching for tax cheats in offshore centers, including Switzerland, as the government tries to curb the budget deficit. Shunned by Swiss and German banks and facing tougher asset-disclosure rules under the Foreign Account Tax Compliance Act, more of the estimated 6 million Americans living overseas are weighing the cost of holding a U.S. passport.

.

This appeared in red in the Drudge Report, the headline being Amnesty for Immigrants.

It would appear to me that the US is following the same steps as the Roman Empire: Seeking Universalism. The gentry leaves or regulates or ascend in Nepotism, and 'Barbarians' are given citizenship.

Hispanic is the New Germanic.

Welcome to the Holy(woody) American Empire of Hispanic Nations.

http://www.businessw...gher-rules-loom

Americans renouncing U.S. citizenship surged sixfold in the second quarter from a year earlier as the government prepares to introduce tougher asset-disclosure rules.

Expatriates giving up their nationality at U.S. embassies climbed to 1,131 in the three months through June from 189 in the year-earlier period, according to Federal Register figures published today. That brought the first-half total to 1,810 compared with 235 for the whole of 2008.

The U.S., the only nation in the Organization for Economic Cooperation and Development that taxes citizens wherever they reside, is searching for tax cheats in offshore centers, including Switzerland, as the government tries to curb the budget deficit. Shunned by Swiss and German banks and facing tougher asset-disclosure rules under the Foreign Account Tax Compliance Act, more of the estimated 6 million Americans living overseas are weighing the cost of holding a U.S. passport.

.