The article looks interesting but it is only for subscribers. Can you paste it here? Thanks....

No paywall when I clicked, here you go:

"

Bloomberg

Subscribe

Photographer: Erica Canepa/Bloomberg

One Country, Eight Defaults: The Argentine Debacles

By

Ben Bartenstein

,

Sydney Maki

, and

Marisa Gertz

September 11, 2019, 7:00 AM GMT-3

Argentina is, by nearly all accounts, catapulting toward default after running up more than $100 billion of debt. Some say it’s just months away. Others say it’s actually already happened on a small portion of bonds.

For even the casual observer, the whole thing has a certain feeling of deja vu. The South American nation is a defaulting machine with few peers in the world.

The first episode came in 1827, just 11 years after independence. The most recent one came in 2014. In between, there were six others of varying size and form, according to Carmen Reinhart, a Harvard University economist. Almost all of them were preceded by boom periods as, perhaps most famously, when European migrants transformed Argentina into an agricultural powerhouse and one of the world’s wealthiest countries by the late 19th century. Invariably, profligate spending, combined with easy access to capital supplied by overzealous foreign creditors, did the nation in.

“The big narrative is always that there’s no fiscal discipline,” said Benjamin Gedan, director of the Argentina Project at the Wilson Center in Washington. “They want to import products that require dollars, they overspend and borrow in dollars, and they don’t generate dollars because they have a closed economy. And so it’s this endless cycle. That’s the story every time.”

Here’s a brief look back at each of the eight defaults — and a look ahead to what comes next.

1827

After declaring independence from Spain in 1816, Argentina’s economy quickly opened itself to foreign trade. Some historians would later refer to the early 1820s as the nation’s “happy experience,” a period of peace, prosperity and fascination with European aristocracy. That soon changed. Argentina had sold bonds in London to help finance its nationhood. That debt came under pressure when the Bank of England raised interest rates in 1825. Argentina defaulted two years later. It took another 30 years for the nation to resume payments on the debt.

On top, Argentina declares independence from Spain. Left, an English illustration of the "Buenos Ayres" flag from 1838 and right, the Bank of England in London in 1828.

Source: Getty Images (3)

1890

In the late 19th century, Argentina went on a borrowing spree to build trains and transform Buenos Aires into the cosmopolitan capital it is today. London’s Barings Bank aggressively invested in the nation’s railroads and other utility projects. The south of Argentina boomed, too, as sheep farming spread across the Patagonian grasslands and gold prospectors rushed to Tierra del Fuego. That euphoria faded when the commodities bubble burst. The nation halted debt payments, spurring a run on Argentine banks and the resignation of President Miguel Juarez Celman. That November, Barings teetered near insolvency. Argentina emerged from default four years later, buoyed by fresh capital from the U.K.

On top from left to right, construction on the Argentine Railway at Mendoza c1905, a postcard of Calle Santa Fe in Buenos Aires and a cartoon depicting 1st Lord Revelstoke, senior partner at Barings at the time of the crisis. Below, a crowd in Plaza de la Victoria (Plaza de Mayo) c1880.

Source: Getty Images (3); The Baring Archive PR/103

1951

An influx of immigrants and foreign capital fueled Argentina’s rise to one of the world’s most prosperous countries by the early 1900s. But World War I hit the nation’s economy hard, as did the Great Depression that followed a decade later. Unemployment and social unrest soared. In 1930, a coup brought the military into power, ushering in a period of political instability — eight presidents in two decades — and a policy of import substitution, which closed off the economy and helped trigger a default.

Clockwise from left, cowboys herd cattle in 1951, vendors pull their cart through a flooded street in Buenos Aires in 1930, a bus burns in Plaza de Mayo during the revolution of 1943 and José Félix Uriburu in 1930.

Source: Getty Images (4)

1956

The populist strongman Juan Peron rose to power in 1946 and proceeded to nationalize companies, redistribute wealth and assert greater government control over the economy. The policies he and his wife, Evita, carried out would become Argentina’s dominant governing principle for roughly half of the next seven decades. Initially, they stoked growth and expanded the middle class. But in 1955, Peron was ousted in a coup, plunging the economy into turmoil and leaving the country struggling to keep up with debt payments. The next year, the military junta struck a deal with the Paris Club of creditor nations to avert a larger default.

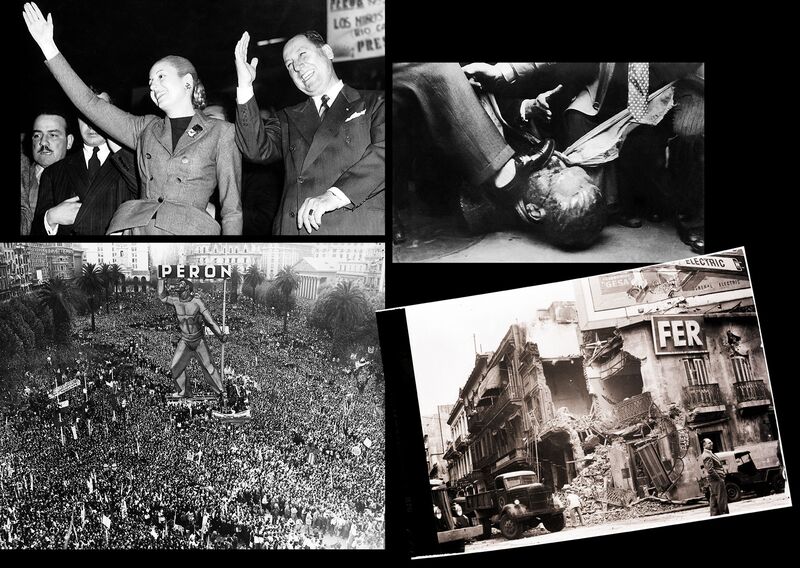

On the left, Juan and Eva Peron salute a crowd in 1951 and Peron supporters gather in front of the presidential palace in 1948. On the right, people step on the face of a bust of Juan Peron, and a building damaged by army tanks and cannon during the revolt in 1955.

Source: Getty Images (4)

news.google.com

news.google.com

news.google.com

news.google.com