I'm confused. If the IMF must receive a NPV equal to the loan they made, then what is being negotiated? How does Black Rock make a profit by purchasing the loan at full price?

Regarding Blackrock, if they purchased their bonds at issuance, roughly 100 cents, then the firm stands to lose a fortune. These negotiations reduced those losses. During the lowest of times, many tranches of Argentine bonds crashed to as low as 35 cents. Any investor purchasing the bonds in that range, stands to make a considerable profit. The trade has been worthwhile for any investor buying at 51 or under.

NPV is a calculation that incorporates a discount rate, a stream of payments and a terminal value (i.e. maturity). To put it simply, it's kinda like calculating a combination of numbers that equal 100. You can have 50 + 50 = 100. Or 25 + 25 + 50 = 100. Or 10 + 25 + 30 + 35 = 100. You get the picture.

I'm oversimplifying, but the same NPV can be reached through innumerable variations to the payments. The options for reaching an NPV are as unlimited as the number of lawyers on Wall St.

In the Argentine negotiations, both sides readily agreed to a payment moratorium of 3 years - due to chinavirus' effects on the Argentine economy. To the best of my understanding, Argentina will not make a payment until 2024. This skews the NPV calculation considerably, and adds greater risk for bondholders. For this risk, they must be compensated in the future - in other words, more money later.

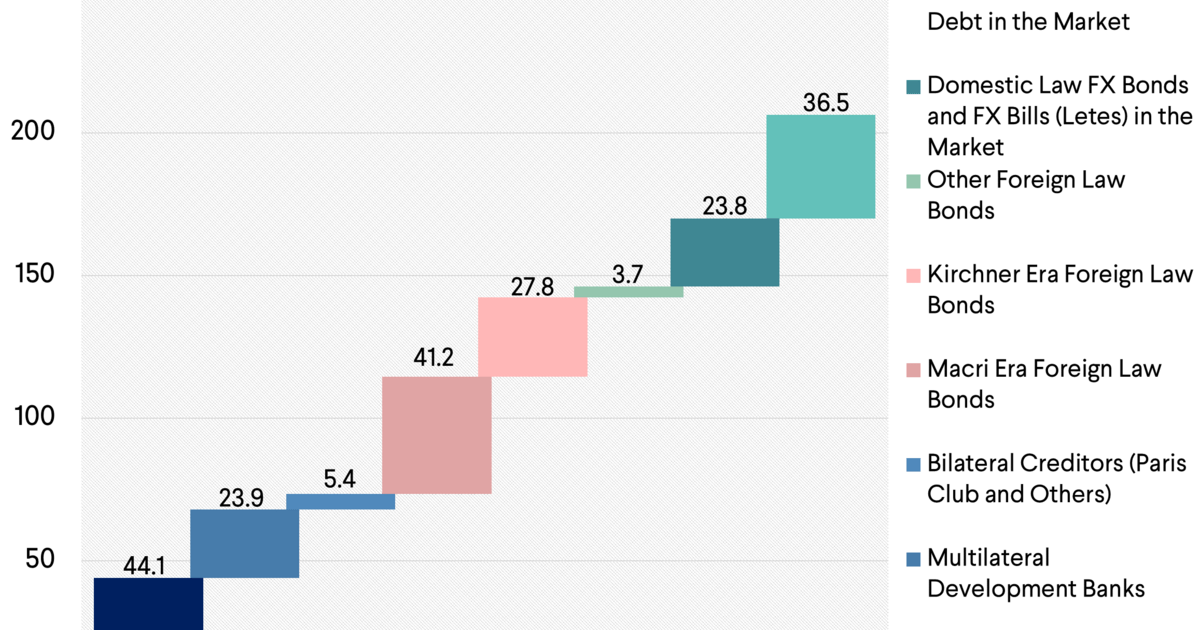

Argentina had considerable difficulty in these negotiations because - for the most part - the numbers are public. Argentina first said it could only pay an NPV in the low 40s. Then it made a "final offer" in the high 40s. Then there was a "final offer" in the low 50s. And now, we have an NPV deal at about 55 cents on the dollar. The hedge funds have Argentina's economic stats and they have teams of competent economists. They knew what Argentina could pay. It's kinda like telling your banker you can only pay $50,000 when he knows you have $100,000 in your account and a job that earns $75,00 per year.

Next up: Argentina vs. IMF.[/QUOTE]