JeffR

Registered

- Joined

- Apr 1, 2019

- Messages

- 96

- Likes

- 150

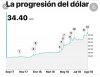

I ran across this article in La Nacion the other day and was wondering if anyone remembers what happened in August of last year that caused this ratio to change so suddenly?

Read the article a couple of times but didn't see an explanation for the 'why', only the 'what'. Trying to figure out the cause and effect, if that makes sense.

La Nacion article link: https://www.lanacion.com.ar/opinion/el-costo-vivienda-relacion-salarios-nid2310118

Read the article a couple of times but didn't see an explanation for the 'why', only the 'what'. Trying to figure out the cause and effect, if that makes sense.

La Nacion article link: https://www.lanacion.com.ar/opinion/el-costo-vivienda-relacion-salarios-nid2310118