antipodean

Registered

- Joined

- Oct 20, 2019

- Messages

- 2,163

- Likes

- 3,320

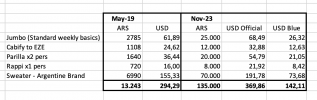

Here is an example of what I mean using real prices I paid for various "day to day" things in 2019 when there was effectively no dollar blue/CCL/MEP etc vs. what I am paying today and how using the official dollar for long term budgeting for most day-to-day expenses is more sensible than using the blue dollar prices in the long term. If you want to take a bit more risk you can consider an amount somewhere between the official and the blue but that will leave your budget more exposed for if and when subsidies or price-controls wear-off and cause a "shock" (e.g. when my electricity subsidy ended I went from paying US$5 blue a month to US$40 blue a month literally overnight and when the government changed the adjustment mechanism for private health insurance my premium also doubled in the space of about three months).So, I disagree with this for a couple reasons:

- The blue also effects the price of goods/services as much as the BCRA dollar; remember when Guzmán was pushed out/resigned? The BCRA dollar stayed flat, yet the blue skyrocketed and so did prices on things like appliances and electronics

- While past performance is not indicative of future results, you can use the brecha between the BCRA dollar and CCL libre (or Blue) to get an idea of what a dollar will be worth if you pair it with the current pace of the crawling peg that has resumed. i.e. if the average devaluation is 4% a month (making this up, not sure what it is now), and the brecha between the BCRA dollar and blue is ~157%, then if the BCRA dollar goes from 350 to 364, one can assume the blue will likely follow going from 900 to 936

- You can use inflation as a guide, not just dollarization, i.e. if you Edesur/nor bill is 20K this month, expect it to be 22,400 next month if inflation is 12%/month. Generally it's less smooth and will stay flat then shoot up at once, but it's still a way you can guestimate

I think being too conservative in budgeting can as unwise as being too liberal, assuming a 2K dollar blue in 2 months for example, but nobody has lost money betting against the peso long term.

Of course some things like rents you need to "dollarize" from the outset even if you get a price in pesos, as the dollar value the owner wants will almost always catch up in the long run while distortions like the brecha may make it excessively "cheap" in dollar terms in the short-term while locked into contract.

Also things like appliances and automobiles have no rules what so ever, the same model LG washer-dryer I purchased for USD 670 in May 2019 now, going by online prices, would cost me almost USD1500 blue; while my car is now worth more than what I paid for it, also in blue terms.

But luckily such purchases don't form part of most peoples day to day budgets and these massive price fluctuations have more to do with (hopefully) temporary scarcity in the market for these products rather than anything else.