gouchobob said:

You can go back through this site and find predictions of an imminent collapse of the dollar from years ago.

Things would, and should have collapsed a long time ago. Pumping in billions of dollars trying to save the banks just delays the inevitable.

Just because it hasn't collapsed yet, doesn't mean it won't. The crisis hasn't gotten better, it has gotten worse, way worse.

notebook.fix said:

Very interesting thread, thanks for starting it Cangurito.

My question is around the subject of 'D E R I V A T I V E S'.

This is supposed to be the real ticking time bomb.

Anyone have any thoughts to share on this?

The problem isn't derivatives, but the FED's decision to bail the banks out. This crazy ponzi scheme should have ended a long time ago. But instead they are now printing money to pay for the losses as no country wants to fund this insanity anymore.

Do you know that the FED is a private bank owned by the very same people who created this crisis in the first place? No wonder they are getting bailed out.

ULDB65 said:

Statistics are fun like that- you can make them say whatever you want. The calculations you list here add all the debt, but forget to count it as assets to someone else.

Mortgage Company A owes $1 to Investment Company B, who owes $1 in taxes to the Government, who owes $1 to a citizen bondholder, who owes a $1 mortgage back to Company A. Your statistics count it as $4 of debt, but its really the same one dollar being passed around. If everyone paid off everyone else, there wouldn't be so much actual debt left. But all that money passing around makes the economy go and keeps people working.

Debt is not necessarily a bad thing. It's true that it does not account for the assets they have. The problem with a lot of debt though, when a person or company defaults, it will have a domino effect. Which is what we will most likely see soon when printing money is not an option anymore.

thomashobbs said:

The dollar has actually strengthened a bit in the last month. It can't go to zero. If the euro keeps rising it will choke off their export industries. Spain already has 20% unemployment and looks a lot like Argentina just before the crisis. All the world's major economies can't simultaneously devalue their currencies. Against what? Martian Pesos? Venutian Dinars?

It can't go to zero? That was exactly what the Germans in the Weimar republic thought. Everything can go to zero. The dollar has been rising, ironically due to the crisis by investors who flee to the temporary safety of the dollar. That probably won't last long though given how much money they are printing.

thomashobbs said:

Just when everyone is saying the sky is gonna fall is exactly the time to buy.

Everyone isn't saying that. In fact the government is saying the opposite. And we all know that the majority of the population are mindless fools who will believe anything that the government is spoon-feeding them with.

gouchobob said:

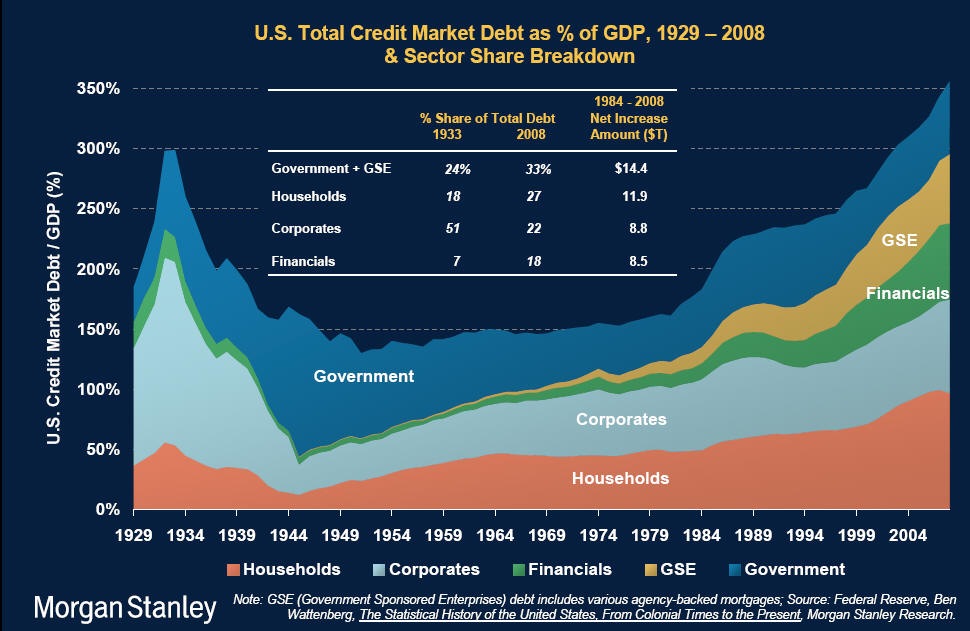

To get a better perspective I think you should look at public debt and what percent it is of GDP(a measure of how well the economy can service the debt). If you look at it this way the US doesn't look great but a lot better than many countries including most in Western Europe and nobody is talking about the collapse of the Euro.

Thanks for the "better perspective", but it's all wrong. And your data is outdated.

Italy is at 115%, USA is around 100%, and most of the formerly virtuous countries are also nearing 100%. And public debt alone is not significant, you have to consider aggregate debt (private+public). USA aggregate debt to GDP is a huge 360%. Italy has one of the lowest private debt in the world.

But I agree, a lot of European countries are in deep trouble as well. And the euro isn't looking to good either.