Joe

Registered

- Joined

- Oct 18, 2007

- Messages

- 2,694

- Likes

- 3,113

Here however you seem to have a very common misunderstanding of the relationship between debt and issuing of fiat currency. Since most currencies are not backed by a reserve (gold or otherwise), when a central bank prints money (or QE or whatever), it is not taking out a debt that needs to be paid at a later time. It owns the printing presses and the monopoly on legal tender, so its constraints on printing are not a limited amount that can be printed without going into debt. Rather the constraint is devaluation of the currency (ie inflation). So for example, the European Central Bank can print forever, but its Euros will only remain valuable as long as people want to keep trading them for goods and services.

When most governments (other than banana republics) print money for deficit spending, they issue bonds (sovereign bonds, gilts, treasury bonds, etc.) to back up that debt. Otherwise inflation would ensue, even Keynes would be on-board with this. Your Econ 101 appears a little rusty...

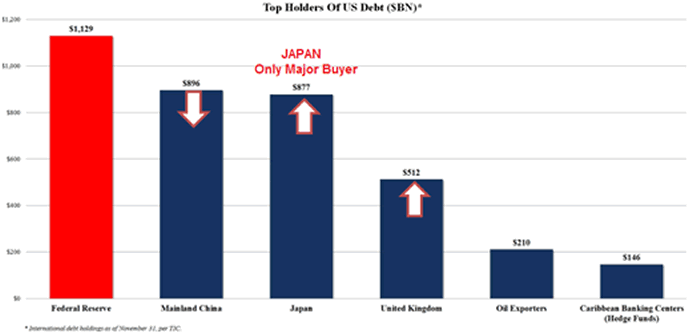

Bonds are a form of debt. The US issues bonds that are purchased by China, Japan, etc. If the USA at some point decides not to honor the interest payments, i.e. default, most - if not all economists - anticipate a global economic maelstrom like none of us have ever seen.

You seem to be suggesting that deficit spending is perfectly fine because the government can print money freely. Taken to it's logical conclusion then the government can all give us a guaranteed income of a million dollars a year.