When most governments (other than banana republics) print money for deficit spending, they issue bonds (sovereign bonds, gilts, treasury bonds, etc.) to back up that debt. Otherwise inflation would ensue, even Keynes would be on-board with this. Your Econ 101 appears a little rusty...

Bonds are a form of debt. The US issues bonds that are purchased by China, Japan, etc. If the USA at some point decides not to honor the interest payments, i.e. default, most - if not all economists - anticipate a global economic maelstrom like none of us have ever seen.

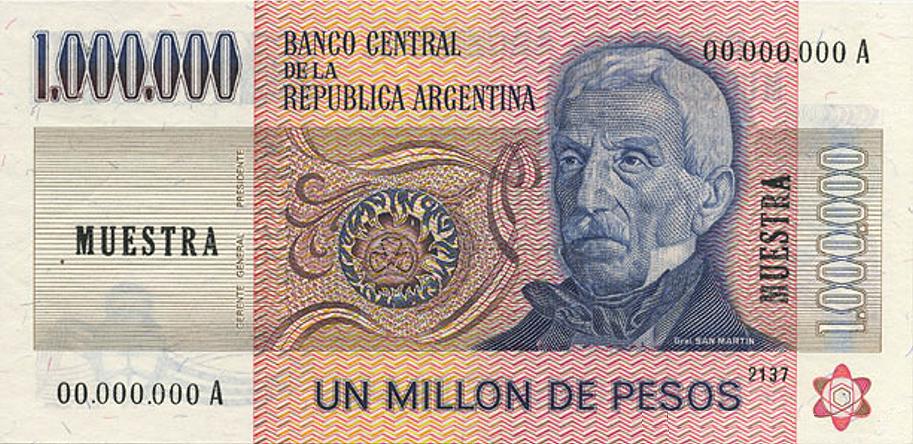

You seem to be suggesting that deficit spending is perfectly fine because the government can print money freely. Taken to it's logical conclusion then the government can all give us a guaranteed income of a million dollars a year.

I do remember Econ 101 (all too bloody well). The first question we ask is "What is money?" Then we learn the difference between commodity currencies (eg gold standard) and fiat currencies (eg US dollar, Arg Peso, etc.) You are confusing the two.

If, for example, the US issues bonds when deficit spending, what are those bonds payable in? Gold? No. in printable USD. So it's a can they can keep on kicking down the road, until (as others have pointed out here) people decide the currency is no longer worth what they say it is. Want payment on those bonds? OK here let me print up some benjamins for you....

Therefore, the basic difference between a commodity currency and a fiat currency is the limits on issuance:

with a commodity currency, issuance is limited by hard reserves (eg gold). If a govt wants to print out more money than it has gold, then it must borrow against future generations' ability to repay. On the other hand,

a fiat currency's limit is not a gold reserve, but the amount of confidence in the currency (ie inflation). The government can print as much as tickles its fancy, but doing so runs the risk of inflation. Thus the govt with the fiat currency could give everyone a $1 m guaranteed salary, but what would happen to aggregate prices? Again the difference is what are the limits on issuance.

You remember that video you posted by Sen. Everett Dirksen? The reason why he could complain in the 1950s about eventually having to pay for all the deficit spending was that he was working with a different currency: gold-backed USD. In 1971,* the US abandoned the Bretton Woods system and made its currency 100% fiat. His question no longer applies because the currency has changed.

* This is probably why Frenchie was the one to remember this event. It was the French that sent a battleship to the US to collect gold on its dollars when the US defaulted on its currency obligations in 1971.