steveinbsas

Registered

- Joined

- Jul 27, 2006

- Messages

- 10,670

- Likes

- 6,956

Yeah, now expats can get back to more important concerns...like how to avoid paying taxes in Argentina (perhaps by not creating a "paper trail" for AFIP to follow).One more over-hyped scare extinguished.

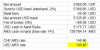

I imagine the one request for igggysnaks to provide a CDI was triggered by the high number of transfers and the total amount of money involved (well over the income tax trigger point for an individual living in Argentina for more than a year).

It's hard for me to imagine that one Western Union employee would just make it up.

Last edited: