I'd buy gold or other precious metals before I bought bitcoins at this point, in order to store value.

I'm actually a bitcoins fan, not because I believe that they are a solution to storing value, but because I believe it (and other crypto-currencies uncontrolled by governments) is a step in breaking the world's governments' control over the people who inhabit the world.

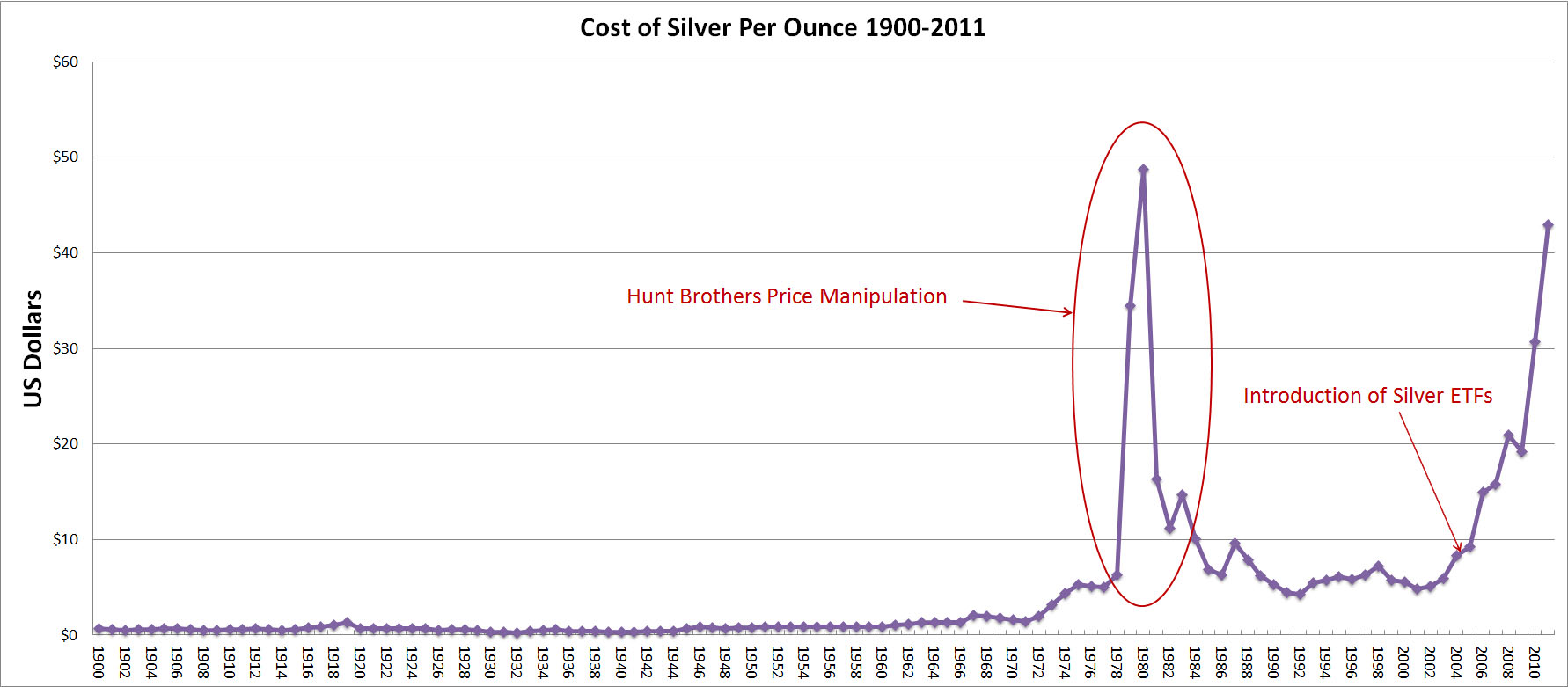

Remember bubbles. Often they are caused by government's meddling in an economy, but that's not the only source of bubbles - speculators can cause them all by themselves. As someone had mentioned previously, remember the Tulip Mania of the 1600s:

http://en.wikipedia....ki/Tulip_mania.

However, Argentina is very quickly becoming a place where bitcoins may indeed have some use, at least in the short-term. The problem always becomes the "storing of value" aspect. If you are a broker of bitcoins (I know some guys who have tried to get me in on this, but I'm hesitant to take a lot of risk because I ain't rich) I could see making money in it as long as you are not holding a large amount of bitcoins if/when it goes south and the bubble bursts. I could see making money in bitcoins if you simply buy and then sell at the correct point.

But remember all those people that bought real estate around the world, as they watched the bubble rising, those who sold made good money and those who bought in too late or left their money in too long had trouble, particularly if they over-extended themselves to buy the property in the first place. But at least with property, if you can hang on to it long enough, you can usually recoup your losses eventually.

Bitcoins themselves have no real intrinsic value. I don't see a way to actually store value with bitcoins, but it may be a good way to exchange values at the moment (i.e., get cash down here, but most likely in pesos), if you can find enough interest going both ways. I've heard of places opening up here that buy and sell bitcoins, and the scheme one of my friends was trying to get me involved in had to do with bitcoin ATMs...

I could be wrong about my outlook on that. Indeed, I've often thought that may be why I am NOT actually rich - I abhor financial risks. I think it's too much a matter of luck to get in and get out at the right times.