Pat Murphy

Registered

- Joined

- Jan 8, 2023

- Messages

- 38

- Likes

- 39

The best days of bitcoin are long gone. No intrinsic value whatsoever.

You can say the same about the USD or any other fiat currency.The best days of bitcoin are long gone. No intrinsic value whatsoever.

Agreed regarding fiat. Have a good night.You can say the same about the USD or any other fiat currency.

If a central bank begins saving exclusively in gold, and global trade imbalances are settled in gold terms, over time some central banks may tire of shipping gold around the world to pay for things.

Although the ownership of a particular stone might change, the stone itself is rarely moved due to its weight and risk of damage. Thus the physical location of a stone was often not significant: ownership was established by shared agreement and could be transferred even without physical access to the stone. Each large stone had an oral history that included the names of previous owners. In one instance, a large rai being transported by canoe and outrigger was accidentally dropped and sank to the sea floor. Although it was never seen again, everyone agreed that the rai must still be there, so it continued to be transacted as any other stone.

Just curious.... what is the largest percentage of bitcoin resident in any Central Bank's sovereign fractional reserve account?Ok Florida Man, keep buying your gold bars.

No one is saying that cyber war fare doesn't exist. I stated it wouldn't be in the interest of the Russians, Chinese or anyone else to take down the global banking system for months. It would turn the rest of the world against them because of the economic pain it would bring to the global economy.

Of course Central Banks are going to hold a diversified portfolio of assets, as should individuals. Brazil for example owns 225 billion in t-bills and 8 billion in gold. You still think holding some gold bars under your mattress and opening a bank account in Norway is going to save you?

Gold has no widespread industrial use case. It is just shiny, physically scarce and malleable. Bitcoin is a far superior alternative.

Regarding Norway's Government Pension Fund Global, you are confused. It invests surplus revenue from their North Sea petroleum industry. And this, as was mentioned, is why NOK is considered a safe haven currency as evidenced by, for the last seven years, NOK has traded in a tight range. And their petroleum industry just got a nice boost courtesy of, allegedly, the US Navy.

Just curious.... what is the largest percentage of bitcoin resident in any Central Bank's sovereign fractional reserve account?

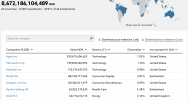

Now I know why you buy bitcoin. You have to be astute enough to understand that Norway's sovereign wealth fund (Government Pension Fund of Norway) is composed of two accounts:This is from the Norwegian Sov Wealth Fund's own website - https://www.nbim.no/en/the-fund/investments/#/2022/investments/equities

70% of their funds are in equities - heavily weighted towards US public companies. How am I confused? Please explain sir.

View attachment 8673

If I had no morals I'd be inclined to do an Iraqi Dinar style scam of cryptobros in Argentina because there's clearly the market for it. I'd liberate them of their pesky fiat in exchange for let's say Quilombo Qoin; it has value if you believe it does.

As for the original topic at hand, I think this week's news makes JP Morgan's insights look like futurecasting; massive nationwide blackout from either failed failsafes or unsecured critical infrastructure and the national hero's FIL getting shaken down making world news, all on the heels of Alberto's speech in which he dawned Rose-colored glasses telling the people they deserved to hear the good things happening (lol)