sesamosinsal

Registered

- Joined

- Aug 16, 2009

- Messages

- 2,048

- Likes

- 1,471

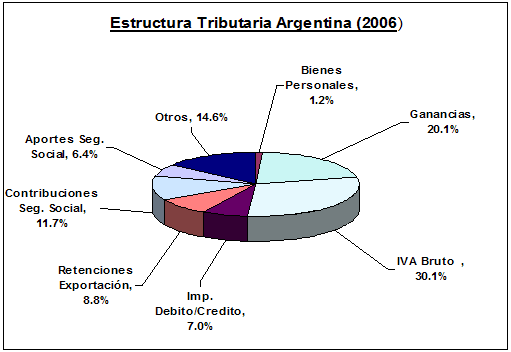

GuilleGee said:I wonder if anyone could find a graph that specifies the percentage of government income from IVA versus other sources?

From 2006... Probably hasn't changed too much?